Unlock Financial Flexibility: Your Guide to Acquiring a Reverse Mortgage

Recognizing the ins and outs of reverse home mortgages is essential for property owners aged 62 and older seeking financial liberty. This unique financial tool makes it possible for senior citizens to take advantage of their home equity, transforming it into available money for various needs, from medical care to lifestyle enhancements. Navigating the eligibility expenses, standards, and benefits can be complex. As you consider this alternative, it is vital to grasp not only exactly how it works however likewise the effects it might have on your economic future. What are the essential elements you should consider prior to making such an impactful decision?

What Is a Reverse Mortgage?

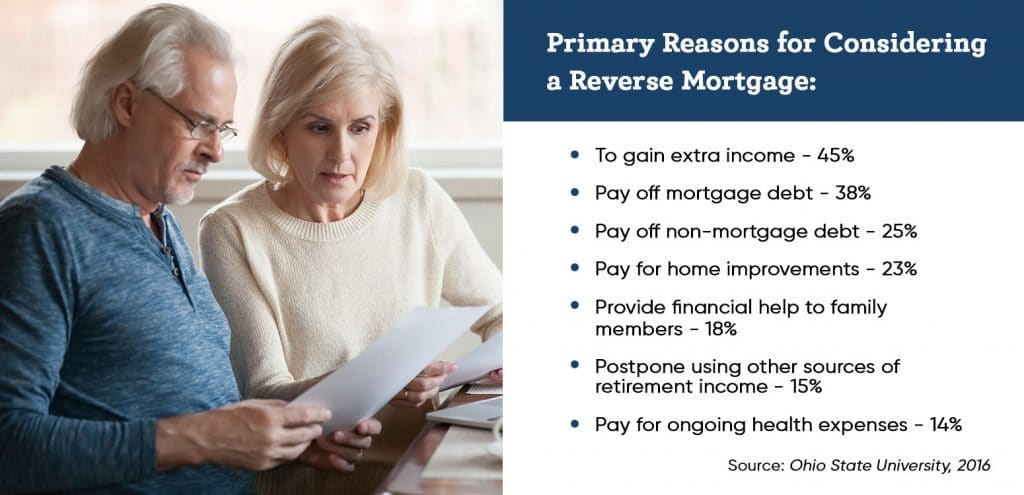

The basic allure of a reverse home mortgage depends on its potential to improve monetary versatility during retired life. Home owners can make use of the funds for numerous functions, including medical costs, home renovations, or daily living expenses, hence providing a safety and security net during a vital phase of life.

It is important to comprehend that while a reverse home mortgage permits boosted money flow, it also lowers the equity in the home in time. As passion builds up on the exceptional finance equilibrium, it is essential for prospective consumers to thoroughly consider their long-lasting monetary strategies. Consulting with an economic advisor or a reverse home loan expert can give useful understandings into whether this option lines up with a person's financial objectives and scenarios.

Eligibility Needs

Understanding the eligibility needs for a reverse home mortgage is essential for homeowners considering this financial choice. To certify, applicants need to go to least 62 years old, as this age requirement enables senior citizens to gain access to home equity without month-to-month home loan repayments. Furthermore, the homeowner needs to inhabit the house as their primary residence, which can include single-family homes, specific condos, and made homes fulfilling particular guidelines.

Equity in the home is an additional crucial requirement; property owners normally need to have a significant quantity of equity, which can be identified with an evaluation. The quantity of equity offered will straight influence the reverse mortgage quantity. Additionally, applicants need to demonstrate the capability to keep the home, including covering real estate tax, home owners insurance coverage, and maintenance expenses, ensuring the residential or commercial property continues to be in excellent problem.

Furthermore, possible consumers need to undergo a monetary evaluation to evaluate their revenue, credit rating history, and overall monetary circumstance. This analysis aids lenders figure out the candidate's capability to meet ongoing responsibilities connected to the home. Meeting these needs is critical for securing a reverse mortgage and guaranteeing a smooth financial change.

Advantages of Reverse Home Loans

Countless benefits make reverse home loans an appealing choice for seniors seeking to boost their financial versatility. purchase reverse mortgage. One of the main benefits is the capability to convert home equity into cash money without the requirement for monthly home loan settlements. This feature allows senior citizens to access funds for different demands, such as clinical expenses, home enhancements, or daily living expenses, thereby minimizing financial anxiety

In addition, reverse home loans supply a security web; elders can remain to reside in their homes for as lengthy as they meet the funding requirements, cultivating stability throughout retired life. The earnings from a reverse home loan can likewise be made use of to delay Social Safety advantages, possibly leading to greater payouts later on.

Additionally, reverse home mortgages are non-recourse lendings, implying that customers will certainly never owe greater than the home's worth read this article at the time of sale, shielding them and their heirs from financial responsibility. The funds gotten from a reverse home loan are usually tax-free, including another layer of monetary relief. In general, these benefits setting reverse mortgages as a practical remedy for senior citizens seeking to boost their financial situation while maintaining their treasured home atmosphere.

Prices and Charges Included

When thinking about a reverse mortgage, it's necessary to know the numerous costs and charges that can affect the overall monetary photo. Comprehending these expenditures is critical for making an informed decision concerning whether this monetary item is ideal for you.

One of the key costs related to a reverse mortgage is the source charge, which can vary by loan provider however generally ranges from 0.5% to 2% of the home's assessed value. Furthermore, property owners must prepare for closing costs, which might include title insurance, evaluation costs, and credit scores record fees, commonly amounting to several thousand dollars.

An additional considerable cost is home loan insurance coverage costs (MIP), which shield the lending institution against losses. This charge is normally 2% of the home's worth at closing, with a continuous annual premium of 0.5% of the continuing to be funding balance.

Lastly, it's important to think about continuous prices, such as real estate tax, property owner's insurance, and upkeep, as the consumer remains in charge of these expenditures. By carefully assessing go to these guys these costs and costs, homeowners can much better examine the economic ramifications of pursuing a reverse home loan.

Actions to Begin

Getting begun with a reverse home loan includes a number of key steps learn this here now that can help improve the procedure and ensure you make educated choices. First, evaluate your financial scenario and establish if a reverse home mortgage aligns with your long-lasting objectives. This consists of examining your home equity, present financial debts, and the requirement for additional income.

Following, research study different lending institutions and their offerings. Seek reliable institutions with positive testimonials, clear cost structures, and affordable rate of interest. It's vital to contrast terms and problems to find the very best fit for your needs.

After selecting a lending institution, you'll need to complete a detailed application process, which usually calls for documentation of revenue, properties, and residential or commercial property details. Involve in a therapy session with a HUD-approved therapist, that will give insights into the implications and duties of a reverse home mortgage.

Verdict

In verdict, reverse mortgages offer a feasible option for elders looking for to boost their monetary security during retirement. By converting home equity right into obtainable funds, home owners aged 62 and older can attend to different monetary demands without the stress of monthly settlements. Understanding the details of eligibility, benefits, and linked costs is crucial for making notified choices. Careful factor to consider and preparation can bring about improved lifestyle, guaranteeing that retired life years are both safe and secure and fulfilling.

Recognizing the intricacies of reverse mortgages is vital for house owners aged 62 and older seeking financial flexibility.A reverse home loan is a financial item created mainly for property owners aged 62 and older, allowing them to transform a portion of their home equity into money - purchase reverse mortgage. Consulting with an economic consultant or a reverse mortgage professional can give important understandings into whether this choice lines up with an individual's monetary goals and situations

Furthermore, reverse home loans are non-recourse financings, suggesting that consumers will certainly never owe more than the home's value at the time of sale, protecting them and their successors from financial obligation. Overall, these benefits setting reverse home loans as a practical option for elders looking for to improve their monetary circumstance while keeping their valued home setting.